Open Banking: better than compete, collaborate

Threats against established companies are intensifying. This was a very real process during the previous decade, and the COVID-19 pandemic has accelerated it. Every day, we see how sectors and products are transformed, and how companies that appeared just few years ago become leaders in a specific sector. At the same time, entities with a long history begin to decline. We only have to watch the impact of Netflix in the media sector, Amazon in retail, Uber in mobility, etc. These are a few well-known cases. But there are many more.

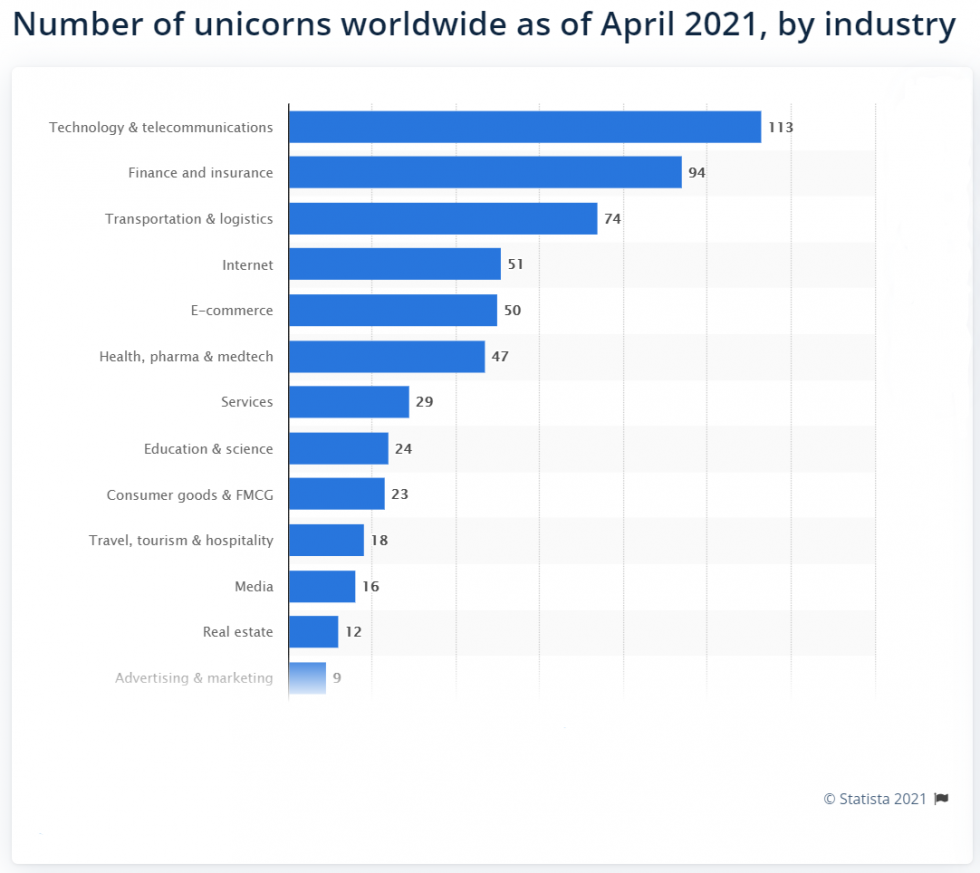

Porter would be proud to see that the “Five Forces” that he identified 40 years ago as drivers of competitiveness are still in force. The negotiating power of customers is an increasingly important factor, as consumers have more and more options and their level of demand doesn’t stop growing. But above all other aspects, the threat of new participants is extraordinary, sometimes even transforming entire sectors: the number of new players continue to rise, encouraged by the low entry barriers offered by cloud technologies and by the growing interest they generate in venture capital. In 2018, 114 companies became unicorns. In 2019 that number was exceeded, with 122 new companies of this type.

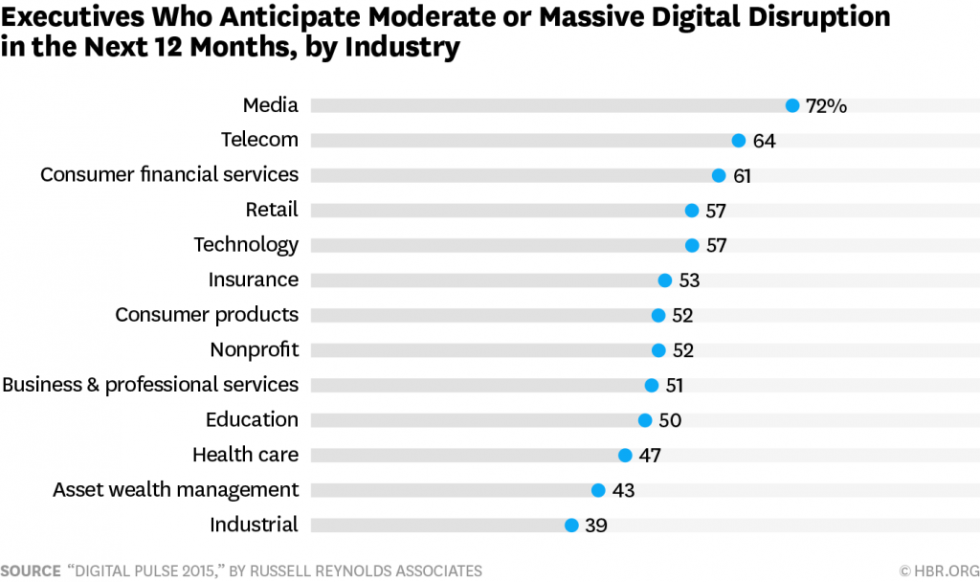

The sector with more unicorns, just behind the broad “tech” one, is the financial sector. For this reason, the banking industry is considered one of the most susceptible to undergo disruption. If we look at it through Porter's eyes:

- The threat of substitute products is getting bigger, for example, in areas such as payment services or P2P loans.

- The threat of new participants is enormous, not only from unicorns, but also from players in other industries that see the financial sector as an opportunity for diversification.

- As a consequence of the above, the clients’ power of negotiating increases, since they have multiple options.

On the one hand, there are new participants that declare themselves as specialists in certain points of the value chain. Among them we could find, for example, PayPal for payment services, TransferWise for international transfers, or P2P loans with Prosper or LendingClub. These new participants rely on the latest technology to offer their products with a very light and flexible structure. In addition, they offer a very good customer experience, with agility, continuous product improvement and intensive use of big data and artificial intelligence technologies. They are cloud-native and AI-first.

Neobanks are a special case. They are entities with a banking license and the particularity that they operate exclusively online. This is the case of Ferratum Bank, based in Malta, Bunq, from the Netherlands, Orange Bank, based in France or N26, of German origin. The credit institution license makes them banks at the same level as traditional ones: they are subject to the same regulation and operate under the protection of a deposit guarantee fund.

In addition to new participants, companies outside the banking sector have begun to offer specialized financial services that traditionally existed only in banks. In 2019, Apple launched its Apple Card. Starting next year, Google will offer its own cards and checking accounts, and Amazon Spain has partnered with Cofidis to allow its customers to finance their purchases.

The success of neobanks and fintechs is transforming the industry. Just a few years ago, branch offices were seen as a competitive advantage, as they offered proximity to the customer. Nowadays, that vision has changed: more and more customers operate through digital devices, and branch offices have come to be considered a high fixed expense that new competitors do not have to assume. By the way, have you noticed that the offices of some banks now look like Apple stores?

In short, current banks face the harassment of new, much more agile competitors with more modern technologies, focused on the user experience and the intelligent use of data, with cloud infrastructures and without fixed expenses “legacies”. The revolution is on and traditional banks know it; this is why they have been making a commendable effort in innovation and digitization for years. However, it is not an exaggeration to state that in a few years the sector will be unrecognizable.

We have already set out the challenges; now, let's take a look at the opportunities. Some will speak of brand awareness as a competitive advantage although, after the previous crisis, it is debatable whether this plays in favor or against the brand itself. Be that as it may, many banks are launching their own digital brands, totally oriented to the new generations; that is, they have understood that for at least a part of the consumers, the “traditional brand” plays against. There is no doubt that traditional banks do have a priceless competitive advantage over new participants: their customer base and the large volume of information they have about them.

The challenge is to build an opportunity on that competitive advantage, to turn this information into knowledge, and use that knowledge to give customers what they want. To do so, it will be necessary to properly get, store and process all this information in order to generate a kind of knowledge that allows to provide customers with the best possible experience, helping them throughout their decision process and even anticipating their needs.

Both traditional banks and neobanks are realizing the benefits of combining ones’ knowledge and access to customers with the others’ technological advantages. Through APIs, now it is possible to connect with financial providers and expand the range of products and services available to users, without the need to produce them from within the organization. This is known as open banking, a model that some traditional banks are beginning to adopt as a possible solution to the coming disruption.

With openbanking there is a beneficial union: banks retain their customers and their information while acquiring the ability to offer all kinds of new products and services through APIs by specialized fintechs. To date, there are already relevant examples such as the partnership between Apple, Goldman Sachs and MasterCard in 2019 to launch Apple Card, or Google Plex, that will be launched next year thanks to a series of collaborations that Google will develop with some banks to offer cards and checking accounts.

The financial sector is undergoing a disruption. The threat of new participants represents a challenge for traditional banking, which has spent years making great efforts to evolve from a digital point of view and also reducing costs. Still, the success of fintech companies is a reality. Uniting the capabilities of traditional banking with specialized fintech through open banking may be the opportunity to generate a positive scenario for both sides.