Open Banking: opportunities and threats for traditional banking

The concept of traditional banking understood as the only branch-based banking or direct personal treatment, does not exist anymore.

There are banks that work only on mobile and other digital channels, and those that are omnichannel since in reality omnichannel banks come mostly from banks with an office channel. Not because you are omnichannel or just mobile, you are more traditional or less modern. Is there any bank without ebanking perhaps? I am afraid not, therefore banking is not a traditional business, it is a business with a strong technological component and therefore “very modern”.

It is true that new figures have recently appeared on the market. The neo banks -generally only mobile- and the challengers -generally digital, in a broad sense-. Check out this interesting Expansion article about the small differences between them two.

There may be a difference between the considered old banks and the new players: the neo banks and the challengers make intensive use of open banking, while the omnichannel not always do.

However, all omnichannel banks, challengers and neobanks can incorporate open banking technology, and in fact they must all do so by law, for example pre-law practices such as screen scrapping are prohibited since the entry of the PSD2 directive. Also it is expected that with the new ECE/1263/2019 Order issued on December 26 on the transparency of the conditions and information required applicable to payment services, it will be necessary to change the concession systems, incorporating Open banking technology to solve the challenges that the future law will pose.

New paradigm: The traditional concept of customer loyalty is changing

Historically, entities try to cross-sell from the current account which is the base product. Most neobanks do not try to be "your bank", but only manage a punctual transaction: your mortgage, your payments, or your credit to name a few. They don't even pretend to be "your other bank", they claim they don't want to know about you, nor do they want to have a personal relationship with you. In turn, they do actually want to become leaders of micro banking practices in many countries as they can.

In addition, banks like N26 or Revolut specialize much more in the user experience than traditional banking players. That is why they also specialize in a few transactions. Although, it does not present a competitive advantage that creates barriers to traditional players, it does give an initial advantage and a better perception of the simplicity of management, at least as far as the residential business is concerned.

In short, we anticipate the coexistence of entities focused on the customer, and entities focused on transactions, and in all business cases much more care in the customer digital experience.

The opportunities we have detected come from the new features of Open Banking, but there is no differential benefit if it is not leveraged on:

- The regulation that forces access to information, the new credit regulation and similar.

- The possibility of operating at the European or even global level with few authorizations from local regulators (Note: they are not easy).

Every opportunity whose origin is in regulation has a double-edged sword:

- If it is an opportunity for you, it is also for your traditional competition (the pool of local banks of each country)

- New players arise in the market, which can enter current customer segments (neobanks and Challengers)

- Changes in consumption and purchasing habits towards global eCommerce that integrate their own payment methods (e.g. Amazon)

- Competition coming directly from big technology companies (e.g. Google Pay)

To the above, we add other factors:

- Uprooting from the office and the person serving me (customer loyalty)

- If we were just a few, now securities agencies will also be banks.

- The speed of Fintech business generation (many do not get traction, but some do), in Spain alone there are more than 300 initiatives.

In general lines according to a study by Funcas and Finnovating:

- 28.50% of customers would choose a new financial provider that was not a traditional entity.

- 41% of users are willing to use fully digital channels to contract traditional financial products and services.

From the outset the conclusions are clear, in Spain part of the market is attentive and willing to change entities for a non-traditional bank, and many are also willing to contract digitally.

These statistics do not take into account age, but it is known that the propensity to change banks is inversely proportional to your age and the years you have been with it. For this reason, young people who have no exit or entry barriers to new options are one of the preferred segments of neobanks. In fact, neobanks have a very low-cost structure that usually makes the segment that is generally not profitable.

I take the opportunity to point out that considering young people as an uninteresting segment is a mistake, as time passes by their propensity to switch banks decreases, and their wealth increases.

For example, Revolut a bank founded in 2015 currently has 1M customers and is worth more on the stock market than any Spanish bank listed on the stock exchange, as published in Expansión.

On the contrary, the segment of older people consumes many more financial, savings and loan products and they are more profitable. It is difficult for them to change entities globally, but they generate many more opportunities for contracting financial services. Many fintech companies do not aspire to be your bank, but to take away your car leasing operation, mortgage, credit card, pension plan, insurance, etc The key here is how they reach this customer, without calls, or visits, etc.

ID Finance, based in Barcelona and barely known, entered € 81 million in 2019, has 3.8M users, and claims to have 35,000 clients join its platform every week. This year they plan to double their income.

Amovens, a company dedicated to car sharing, with more than 300,000 clients, also sells car rentals. In 2019, it sold more than 10,000 vehicles completely online, without brand dealerships or a bank office.

Open Banking is the accelerator of these new players that we are already experiencing, an open door to quick, immediate concessions, with few questions. The playing field is no longer the bank office because the client is not interested in asking for their options on-site. It is on the internet, mobile, in every place where there is a purchase/sale transaction or a savings opportunity. And also the playing field, the market, is international.

'If in your usual bank you have ebanking, the door to get better products and financial conditions is open. You can use this data to transfer it to third parties. '

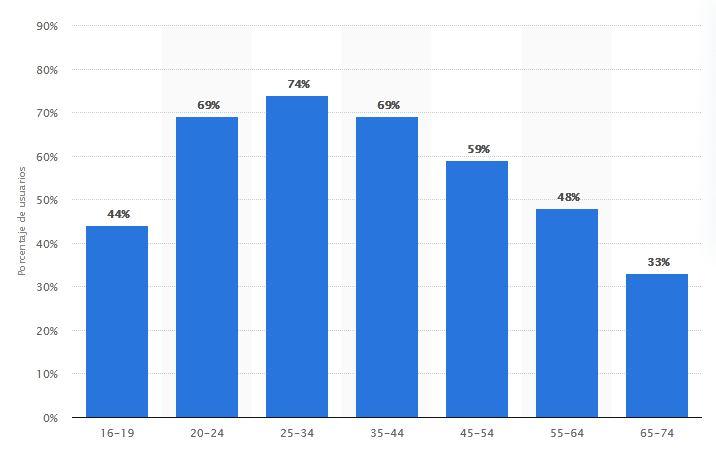

No need to convince yourself, the data is there: 74% of banking clients in Europe between 25 and 34 years old have ebanking or mbanking.

It is true that if your clients are not very digital, you have less risk that their transactionality may go to another entity or neobank (a client without electronic banking cannot give consent to access their data to another bank), and conversely, it will also be difficult to achieve transactionality that do in another entity. But there is no reason to be calm. Probably that client that is not very digital is due to age and, unfortunately, will last less time (customer lifetime value).

I want to add one last idea. Currently most of the services can be done by ebanking. Some entities such as Caixabank accumulate the 33% of clients with ebanking in Spain. In addition, almost 50% of the clients of the old bank have ebanking.

We can anticipate to have in the long run almost all banking transactions will be done online. This also means that sooner or later all clients and all transactionality will be operated or accessed through openbanking.

Our general recommendation is that any product or operational innovation initiative should be reviewed based on Openbanking technology. If there are two alternatives to approach the same digitization of a “customer journey”, overweight the option of doing it with open banking technology.

You can find some recommendations for onmichannel banks, which will not apply in all cases, as follows:

- Copying is innovating: if there are only 300 fintech companies in Spain alone, it is easier to copy ideas or buy them than to have a great groundbreaking idea from scratch. Intrapreneurship is always complicated.

- Take advantage of capillarity: the traditional network is a constant flow of ideas and opportunities, so channeling them properly is advantageous. Identify each focus of transactionality on the internet and connect to it with your APIs.

- Using existing technologies and connecting them: It is easier to acquire or adapt vendor technologies than to develop from scratch. Everything changes at a fast pace, the risk is high.

- Open your sandbox: open secure playing fields for third parties to develop APIs that connect to yours. Obviously there will be a high mortality. But he who gives first, gives twice.

- Attentive to the life cycle: With current clients, anticipate their needs with AI technology, and to capture new ones, catch them with online transactions: renting, financing.

- The territory is international: follow your e-commerce clients internationally to attract private clients. BNEXT offers you a card when you pay at one of their virtual POS, e.g. What you do not do, others will do.